It’s beginning to look a lot like Christmas. Or at least, it will. All too soon, the weather will turn colder, evergreen trees will be available about every five miles, and you will be blasted by Christmas cheer. Which means, there is not a better time than now to set up your own Christmas Savings plan.

I am including a free Christmas savings chart and Christmas budget calculator to help you stay on track with your savings at the bottom of this post.

The holiday season can be full of joyful memories, time spent with loved ones, and fantastic memories. But it can also be filled with loads of credit card debt, chronic overspending, and all the advertising.

By planning ahead, you can spend this Christmas relaxing with a hot cup of cider while you listen to your favorite Christmas tunes and watch the snow fall. Instead of the constant crush of worry, you will have the surety that you do have enough money for Christmas this year. Instead of racking up credit card debt or deciding who to leave off the Christmas gifts, you will have a great Christmas budget that will help you as you shop.

Save this post for later.

According to the American Research Group, the average Christmas budget for American shoppers was $992. I don’t know about you, but $1,000 is a lot to drop in one month. Not to mention the other expenses that come up like charitable donations, extra electrical expenses, Christmas decor expenses, and delicious baked goods

No wonder the average American credit debt from Christmas is a whopping $1,054. [cnbc] I believe there is a better way. In this ultimate guide, you can learn how to save money for Christmas now so you will have more than enough to spend this Christmas.

How can I be debt free for Christmas?

I don’t know about you, but the stats really freak me out. *Cue horror music.*

Maybe I am being a little dramatic, but there has to be a better way. I can’t accept that millions of Americans are spending money they don’t have during the holiday season when they really don’t have to. What if I told you, you could have a wonderful Christmas without any debt or without overstretching your budget?

Maybe you are like me. You sit down and just can’t find any extra room in your budget. By the time Christmas rolls around, you have been squeezing every penny until it screams and just want to do something nice without having to stress about money.

For me, my budget seemed like it had given until there was almost nothing left. I had cut and saved in any and every way Dave Ramsey and every other financial blogger said to. But, I still couldn’t seem to find the money I needed for Christmas. Then, I found out exactly how to make a good Christmas budget.

When you have a budget and know how to save money for Christmas, you will find yourself having a holly jolly holiday instead of stressing your way past it all without enjoying any of it.

I promise, it is completely possible. These savings plans are the methods we used to buy thoughtful, meaningful Christmas presents for 20 people with enough left over to splurge on eachother while Hubs was unemployed. And just to clarify, I am a teacher in the state with the 45th lowest teaching salary in the United states. Having a Christmas savings plan really does work.

What is a good Christmas budget?

So, what is a good guide for your Christmas budget? The simple answer is what you can afford. I know it is extremely tempting to reach for your credit card to really make this Christmas “nice.” But, how much will you be paying in the long run?

Calculating a doable Christmas budget is simple. Start with how many months are left until Christmas. From there do a budget audit. What areas can you cut back on for the next “X” months.

- Could you give up your daily coffee?

- Maybe try packing a lunch instead of eating out?

- Cut back your clothing budget?

- Use energy saving tips to cut your electric bill?

- Designate a “no spend” week once a month with all the saved money going to Christmas?

Once you see how much you can save per month, multiply that by how many months are left until Christmas.

Set up a separate savings account. By keeping the money in a separate account, you set up a mental barrier. It is far easier to resist spending your Christmas savings if it isn’t at your fingertips with easy access from your checking account.

Remember, saving money for Christmas is a long term game. The farther ahead you plan, the less pressure you put on your budget. For example, if you start saving in January, you have approximately 11 months to save money for Christmas.

So, if you plan on saving $100 each month, you will have more than the average $998 Christmas budget. If you have fewer months, you will have to save a little more each month to get closer to that goal.

Beat Christmas Budget Pressure

Pro tip, even though the average American Christmas budget is $998, you do not have to spend that to have a nice Christmas.

Hubs and I usually spend around $500. And that is with stockings for 7, gifts for 15 family and friends, Christmas cards, a splurge gift for ourselves, and other holiday cheer (baked goods and special treats for acquaintances). We both like to give gifts, but good gift planning and frugal shopping hacks makes our large gift load possible.

While spending $1000 a year around the holidays might be nice, it is not necessary. If you need to spend less, spend less. And don’t look back. Because this time of year is about family. Set up inexpensive or free traditions, enjoy time with family and friends, try giving something handmade, and prioritize others. I promise, you will enjoy your Christmas more because of it.

So, where does the money come from?

Saving money for Christmas

Once you have a budget in play, you have to decide how to save money for it. You might be feeling a little overwhelmed at your savings goal, but with a good Christmas savings plan and a little determination, you can easily get your Christmas money.

Christmas Savings Plans

Deciding how to save money for Christmas can be overwhelming. Finding the right Christmas savings plan for you is vital to your success.

- Save money weekly

- Save money monthly

- The $5 savings Method

- Earn Money through Side Hustles

To help get you started, I am including a free saving for Christmas chart that will help you keep track of all the great saving you are doing. Download it, at the bottom of this post.

Save Money for Christmas Weekly

If the Christmas countdown is ticking away, and you are feeling the cinnamon scented pressure to purchase for your Christmas list, a weekly savings plan is a great one.

Breaking your budget into weeks can help you simplify your budgeting audit. I also like to call this the bite sized plan to saving because it seems a lot easier to find ways to cut and save $25 a week than $100 a month.

Cut your grocery budget down by $5 a week. Save $15 by skipping the take out and coffee. Carpool and save a couple dollars. Working on a smaller scale may seem less daunting, but is just as effective.

Other ways to cut your weekly budget:

- Shop thrift stores for clothes and household items (possible savings — $20/week)

- Use coupons (possible savings — $15/week)

- Shop grocery ads (possible savings — $15/week)

- Eat out less (possible savings — $50/week)

Save Money For Christmas Monthly

This plan is the most commonly used savings method. This is a great way for all you planners out there. If you start Christmas shopping in June, you know who you are, this is a great way to get your Christmas money. When you can aside a portion of your income each month for Christmas starting in January, come December, you will have all the funds you need to heap the gifts under the tree.

If you shop throughout the year, you will always have some funds available when you find that perfect gift. Just be sure to keep track of your spending so you don’t break your budget.

For this plan, budget in the amount you want to save each month. If you start saving $100 each month, by December, you will have $1200 saved for Christmas.

Treat the money you are setting aside like a bill. Open a savings account for your Christmas money and Christmas money only. Transfer your decided on portion of money to the account once a month. Some savings accounts even set up a direct withdrawl into a special Christmas savings account.

Saving money for Christmas monthly is a great long term plan. I call it the long game to Christmas. Since Christmas comes once every year, planning ahead can both help you have all the money you need and feel good about it.

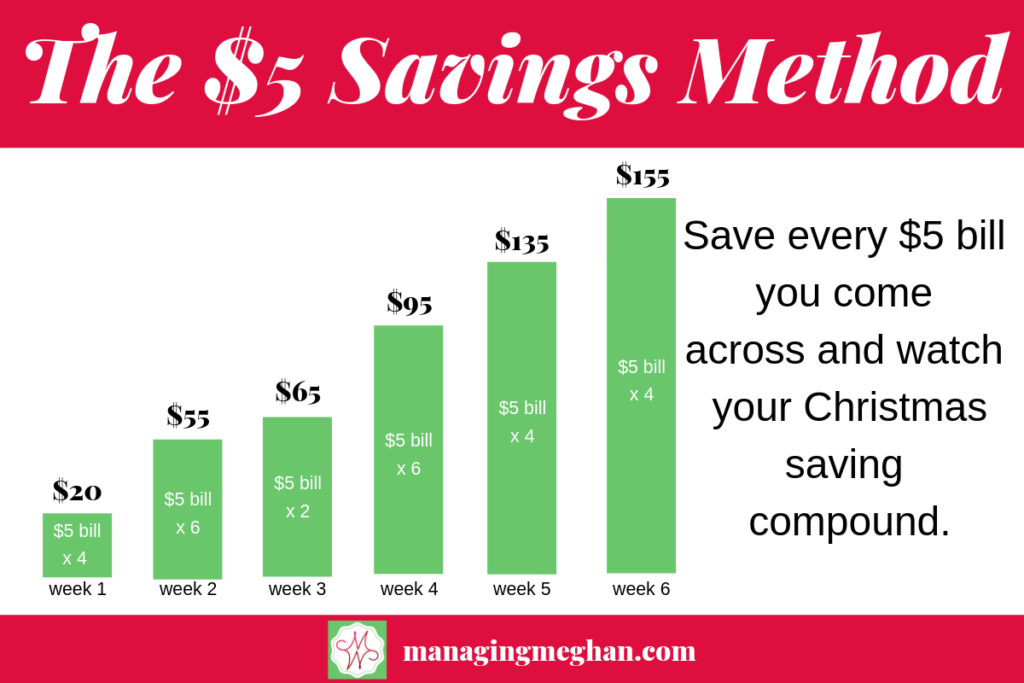

The $5 savings method

Ok, cash lovers. If you use a cash budgeting method or an envelope system, this might just be the simplest savings plan ever. Every time you get a $5 bill put it aside. Aaannnd, that’s it.

Over the year, the $5 bills add up turning into a hefty sum for Christmas shopping.

If you like a tangible to help you feel motivated, keep your eyes peeled for every $5 bill in your possession. If you are feeling overwhelmed about how to save money, this plan is simple to execute. Just make sure you don’t dip into that Christmas savings until it is time.

I have never used the $5 method to save for Christmas, but I have used it short term to save for a trip. I found that the $5 didn’t really make much of a difference to my daily budget, and I came across several of them a week. Try it, and you might be surprised how much you can save in a short amount of time.

Earn Money through Side Hustles

Sometimes you just don’t have the wiggle room in your budget to save for Christmas. But that doesn’t mean you are left out in the cold. Quickly stash money away by getting creative and supplementing your income. It doesn’t even require getting a holiday job.

There are many work from home options that allow you maximum cash for minimum hassle. Some of my favorites are.

Door Dash

If you know your city well and are willing to drive around a little, Door Dash is an excellent way to earn extra cash. Door Dash is a food delivery service. Last Christmas, we hadn’t saved as much as we wanted. Hubs started driving for Door Dash and made $350 in 3 weeks. Sometimes I would drive out with him (some homemade coco in hand), and we would find all the best Christmas lights displays in our city.

VIP KID

This is the most profitable side hustle on this list. VIP KID is an online tutoring program. You will be connected to young English Learners in China to help teach them English. Don’t worry, though. You don’t need experience, just any bachelor’s degree and a TSOL certificate. Word of warning, it is a long term game. You will need to build clients. I started teaching for VIPKID in November and made less than Hubs did with Door Dash. By December, I was making several hundred a month. Now, I make over $800 a month teaching for about 2 hours a day.

Swagbucks

You don’t even have to leave your couch for this one. Get paid to watch videos, shop online, play games, and take surveys. Download the app and get started earning some extra mulah today.

Ibotta

You are probably already shopping during the Christmas season. Why not get cash back. Download the app and scan all of your receipts. If there are any cash back offers available, they will be added to your account. Make your shopping work for you all year, and set up a nice Christmas nest egg.

Get my free Saving for Christmas Chart

Once you know how to save money, you need a way to keep track of it. I like to use a saving for Christmas chart to watch my Christmas money grow.

Having a visual representation of my goal helps me stay super motivated. When the money is building in the background, it can be easy to forget. Keep your savings goal in the front of your mind so you can stay motivated and have a great Christmas budget.

Snag this cute saving for Christmas chart to easily save money for Christmas and stay debt free this year.